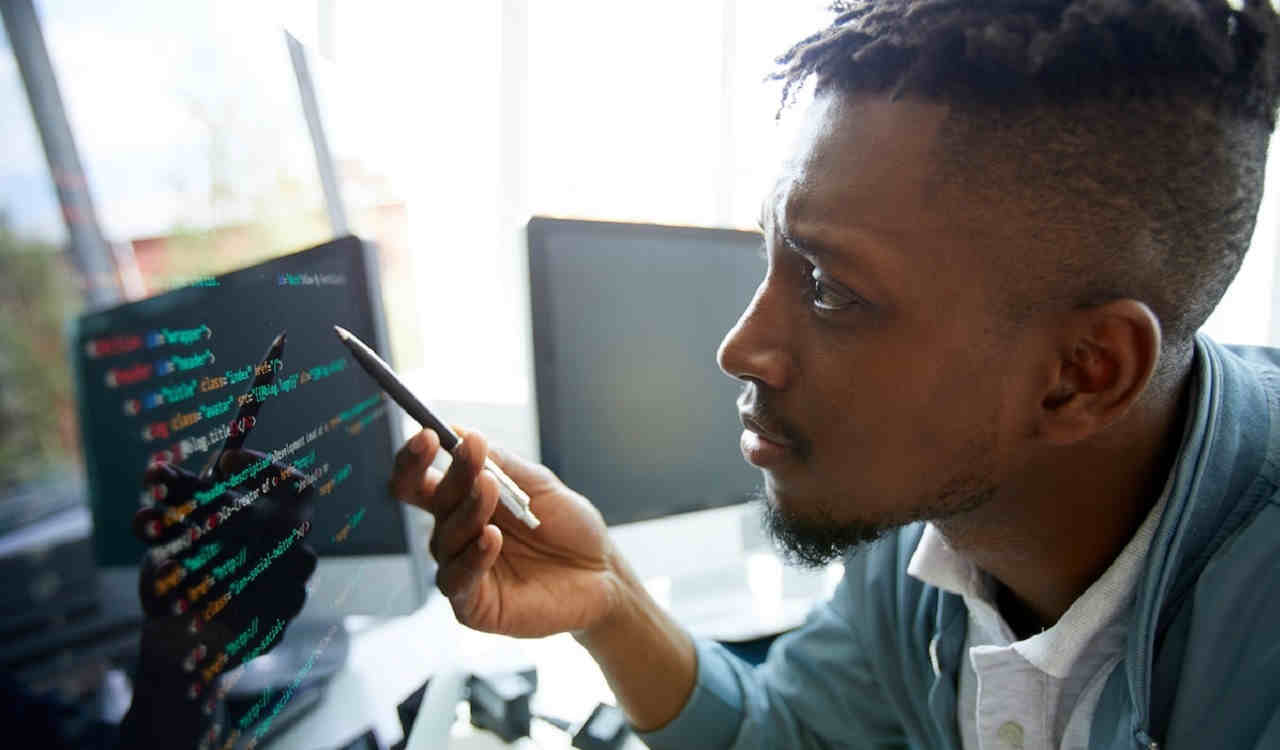

Checking the Uptime

Just like any internet server, you need to check their uptime or speed. This will give you a clear idea what to expect from them in terms of speedy service. But keep in mind that there is no such thing as 100% uptime.

Fast uptime enhances your online backup experience. You should be able to upload, download, share, sync or do whatever you want to do with your online cloud. This should be fun for you. A decent uptime enables you to have this luxury.

Help and Support

Never underestimate the power of customer service. No matter which cloud you choose, there will always be complications or glitches. That’s why a company who can be there for you when you need it is the right one.

You don’t want to be left hanging, waiting for a reply to the email you sent the company two days ago. Customer service that is helpful and useful is priceless. You can check this feature by searching for customer feedback.Keep your eyes and ears open!

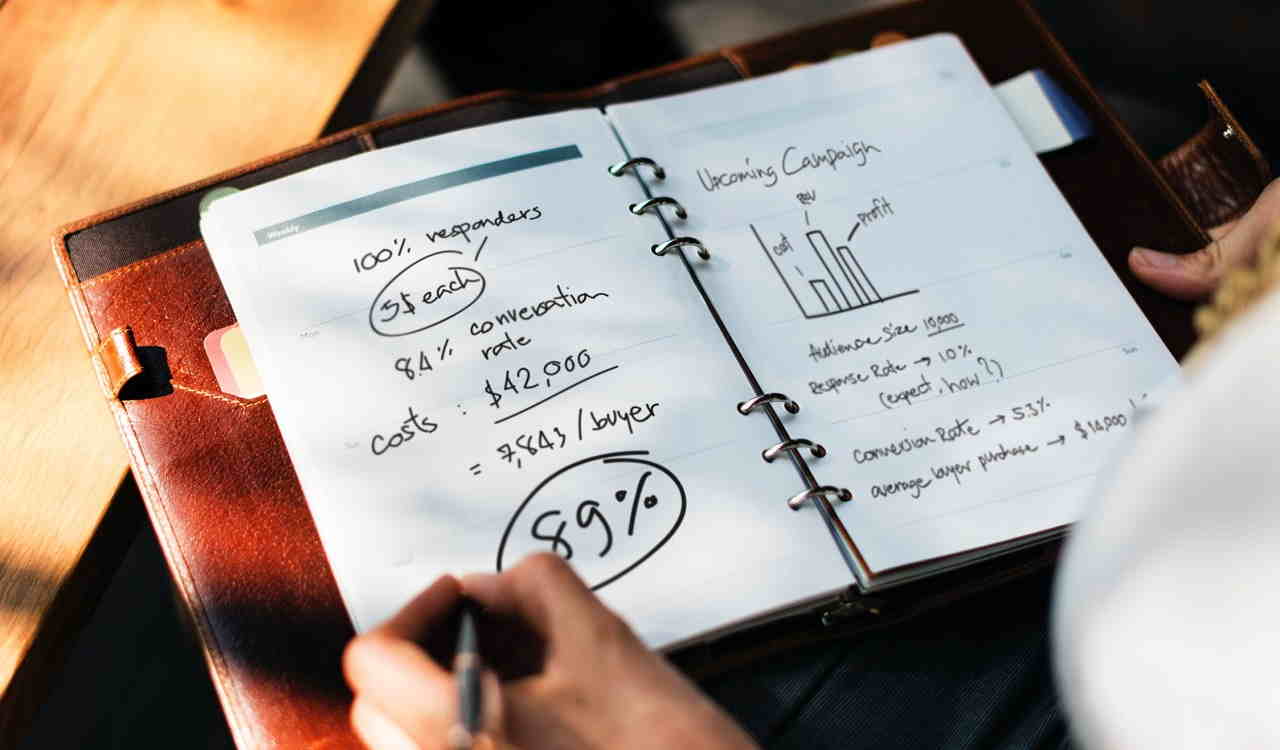

Price and Budget

Many online backups provide similar services but at different prices. This is what you need to look at more closely. Only choose those cloud services that you can pay for through their whole subscription. Don’t let it get cancelled in the middle of your upload because it is proving too expensive now.